When you make the decision to buy that first new house, it’s a big deal. Like, “keep you up at night thinking about it” big deal.

If you’ve been paying rent for a while, buying a new home could seem like the cheaper choice. And there are plenty of benefits for first time home buyers.

Here’s one big piece of advice though.

When buying a new house, know what to expect.

Of course, you can never fully know what to expect. With buying a house, there are always going to be unforeseen obstacles.

But there are expected payments and fees that you can be sure will be part of the process. So it’s best to get familiar with them before you take the plunge.

Down Payments

You want a good interest rate. But in order to get that rate, you’ll need to make a down payment on the house. You can expect at least 10%. So, for instance, on a $170,000 home, this will be $17,000.

And if you want to avoid private mortgage insurance (insurance that protects the bank in case you’re unable to pay your loan), it will need to be at least 20%. So now that $170,000 house will need a $34,000 down payment.

Homeowner’s Insurance

Maybe you had renter’s insurance, so this isn’t entirely new to you. But homeowner’s insurance is usually going to run you considerably more than renter’s insurance.

And it’s required before you take possession of your home. So once you’ve gotten mortgage approval and done all the footwork to get your new house, you’ll need to shop around insurance companies to find the best rate.

The good news is, you can lump your car insurance with your homeowner’s insurance and possibly get a discounted rate.

Property Taxes

This one often catches new homeowners by surprise.

If you’re folding your property taxes into your mortgage payment, that’s going to be an extra bundle of money you’ll need to pay each month.

For example, if you’ve been paying $1000 per month in rent and the mortgage payment on your new house will be around that amount, you might think you’re good to go.

But, if your yearly property taxes are $2400, then you’re looking at adding another $200 per month. So when you budget for your monthly payments, don’t forget to figure in your property taxes divided over 12 months.

Payments and Interest

Obviously, you have to pay your mortgage principal.

At the beginning though, much of your mortgage payments will be going toward paying just the interest. So you want to be sure you’re getting the best interest rate possible.

In the long run, a great fixed rate could end up saving you thousands of dollars.

And that’s just the beginning

On top of the above-listed considerations, there are other things like the fees tied up with escrow, tax services, as well as getting credit reports and a home inspection.

Still, there’s nothing quite too exciting as getting that new house for the first time. It doesn’t have to be scary. If you approach the experience armed with some knowledge, you’ll end up with a place you can truly call home.

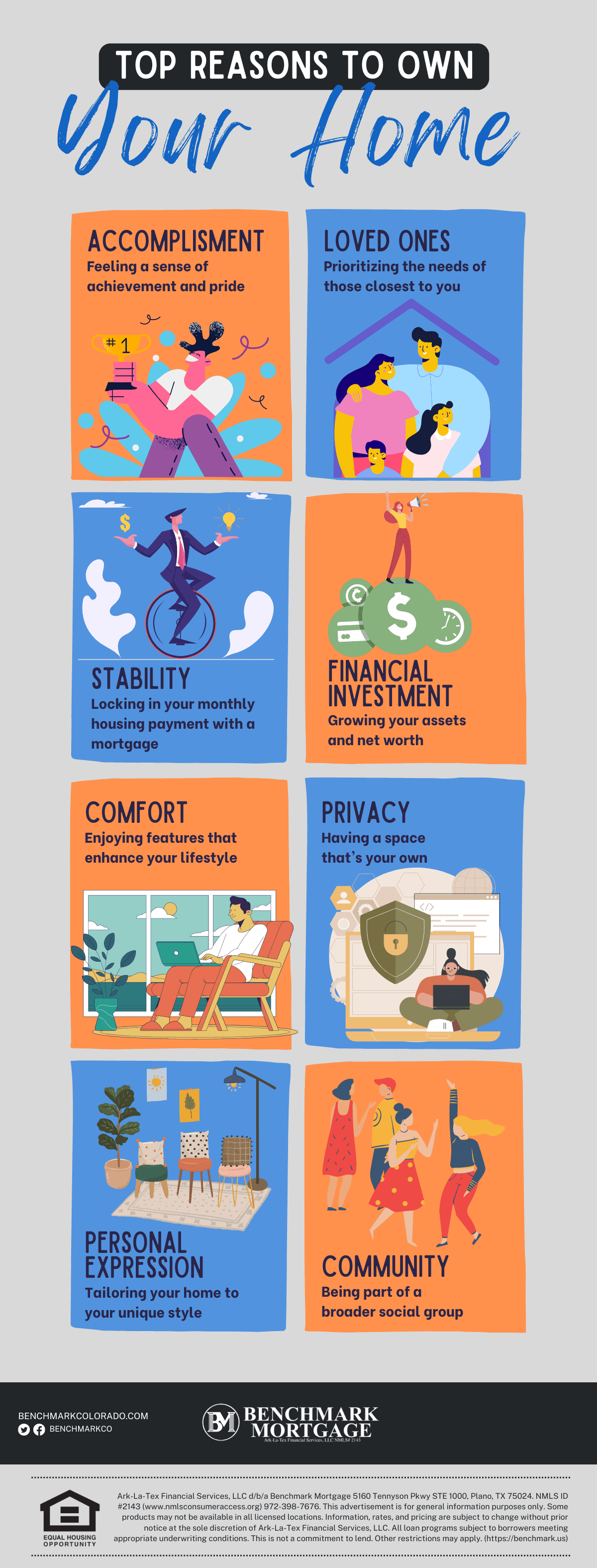

Top Reasons To Own Your Home

Do you have any other helpful tips for those looking to buy a new home? We’d love your input!